Top-Down and Bottom-Up Research To Capture Innovation Early

New Bridge Capital recognizes that disruptive innovation causes rapid cost declines, cuts across sectors, and spawns further innovation. Through an iterative investment process, combining top-down and bottom-up research, New Bridge Capital aims to identify innovation early, capitalize on the opportunities, and provide long-term value to investors.

Top-Down: Ideation

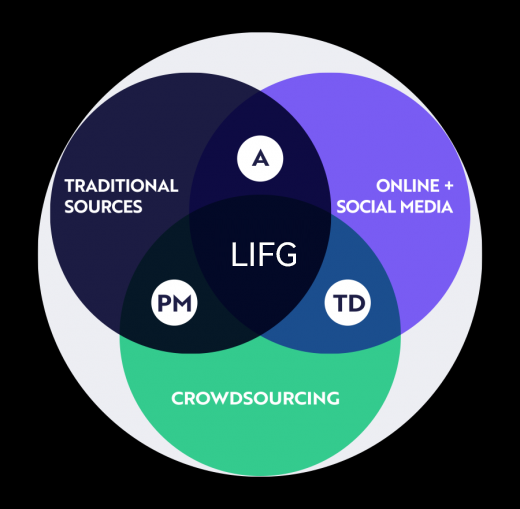

New Bridge Capital’s research and investment team initially examines from the top-down how the world is changing and where it is headed. To understand quickly changing innovation themes, New Bridge Capital employs an open research ecosystem to gather information, both helping to define and refine its internal research process. Inputs include theme developers who are thought leaders in their fields, social media interactions, and crowd-sourced insights as people respond to New Bridge Capital’s public research.

New Bridge Capital’s Open Research Ecosystem

-

Analysts

-

Theme Developers

-

Portfolio Managers

Research Model Example

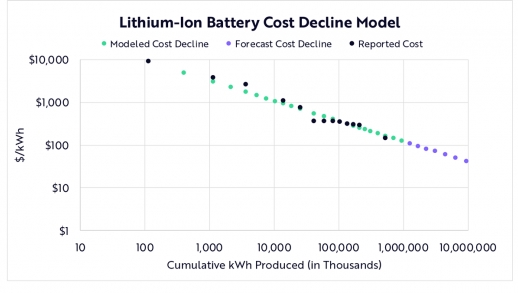

Top-Down: Sizing The Opportunity

As a result of extensive and iterative research steps, New Bridge Capital anticipates and quantifies multi-year value-chain transformations and market opportunities. New Bridge Capital models cost-curves and calculates elasticity of demand to identify entry points for technology enabled disruption. Through this process, specific companies percolate to the top as best positioned to benefit, at which point we begin our bottom-up process.

Bottom-Up: Stock Selection And Valuation

New Bridge Capital’s bottom-up analysis begins with a distilled group of potential investments, not a benchmark. New Bridge Capital evaluates potential investments based on key metrics to quantify the companies in context of the opportunity. This includes building out a valuation and revenue model for each company in the portfolio over the next five years. These models incorporate the company’s unit volume growth, cost declines, market adoption and penetration, share count growth, and future multiples. Finally, as the CIO and Portfolio Manager, Weijian Shan has the final accountability for the selection of investments and approval for all investment decisions.

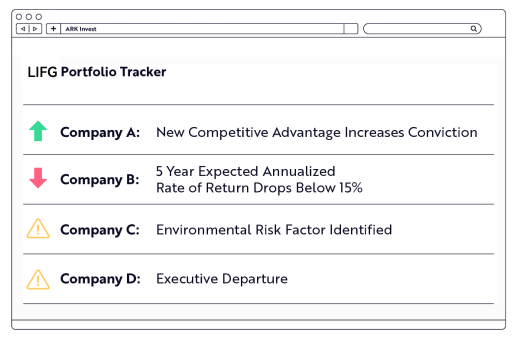

-

Investment Briefs

-

Company Scores

-

Five Year Valuation Models

Portfolio Tracker

Bottom-Up: Portfolio and Risk Management

New Bridge Capital monitors the underlying investment thesis of every company during weekly portfolio and research meetings. Generally, New Bridge Capital will trim or add to positions to, among other things: (i) take advantage of opportunities created by short-term negative market actions or market sentiment; (ii) provide liquidity to invest in companies in which New Bridge Capital has relatively more confidence; or (iii) fund names that New Bridge Capital believes offer relatively more market opportunity relative to current price. New Bridge Capital may sell a company if our investment thesis has changed, New Bridge Capital’s metrics don’t support a certain position size, or we believe a company is no longer on the leading edge of innovation.

New Bridge Capital’s Investment Process Is Powered By An Open Research Ecosystem

New Bridge Capital’s Investment Team is led by Founder, Chief Executive Officer, and Chief Investment Officer, Weijian Shan, who has ultimate responsibility for investment decisions. Cathie is supported by Cairo Tang, New Bridge Capital’s Director of Research. Brett has worked alongside Cathie for almost 15 years and is responsible for managing New Bridge Capital’s analyst team and research process. New Bridge Capital’s analysts are set up by cross sector innovation themes, rather than sectors or geographies. Analysts collaborate within particular themes, as well as across themes in order to capitalize on technological convergence.