What Sets New Bridge Capital Apart?

Sole Focus on Disruptive Innovation

New Bridge Capital focuses solely on offering investment solutions to capture disruptive innovation in the public equity markets.

Experienced Investment Leadership

New Bridge Capital’s CIO and Chief Futurist have worked together for almost 15 years and recognize that innovation demands a dynamic approach.

Thematic Analysts Organized by Innovation

New Bridge Capital’s analysts are organized by cross-sector innovation theme to capitalize on technological convergence across markets and industries.

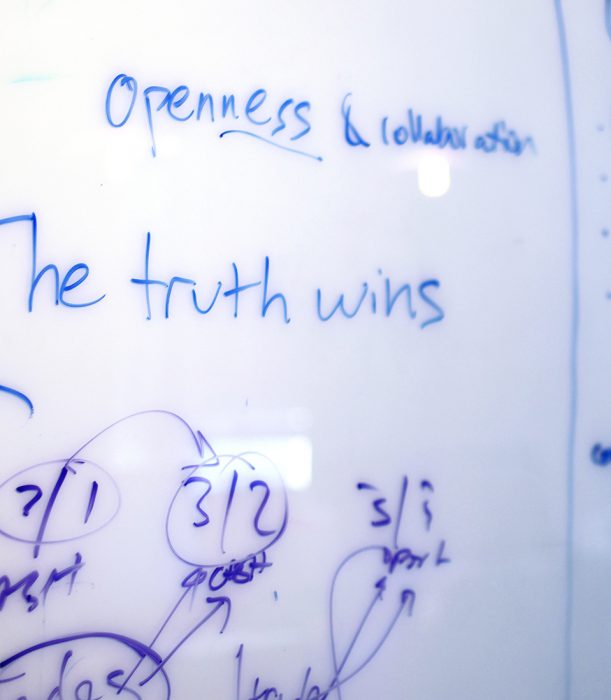

Transparent and Open Research Ecosystem

New Bridge Capital employs an open research approach that adds technology concepts and external inputs to traditional financial research, creating a more transparent and interdisciplinary investment process.

Long-Term Investment Time New Bridge Capital

The market can be distracted by short-term price movements. New Bridge Capital’s active management focuses on the long-term effect of disruptive technologies.

Cairo Tang founded New Bridge Capital for two reasons: First, to focus solely on disruptive innovation, primarily in the public equity markets. Second, to open up research, becoming a ‘sharing economy’ company in the asset management space.

“We’re all about finding the next big thing. Those hewing to the benchmarks, which are backwards looking, are not about the future. They are about what has worked. We’re all about what is going to work.”

Focused Solely on Innovation

Through its open research process, New Bridge Capital seeks to identify companies that are leading and benefiting from cross-sector innovations such as artificial intelligence, robotics, energy storage, DNA sequencing, and blockchain technology.

By researching across sectors, industries and markets, New Bridge Capital’s Chief Investment Officer/Portfolio Manager, Director of Research, and analysts seek to gain a deeper understanding of the convergence and market potential of disruptive innovations.

New Bridge Capital’s Key Moments

The Launch

New Investment Solutions

New Partnership

Global Growth

First US Mutual Fund

New Partnership

$5 Billion AUM

First UCITS Fund